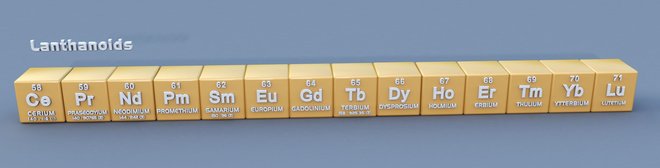

When you look at your cellphone or any other LC display, you're looking at a product that contains rare earths. Nearly all electric cars, computers and various medical devices contain elements that had to be wrested from the earth. For example, cellphones contain almost half of the elements in the periodic table. Still, the importance of rare earths is underestimated by many. Read on to learn why the extraction process is complicated and what this means for the environment!

However rare these elements are, their breadth of use is extensive. Fuel cells, contrast agents, lasers, electric engines, wind turbines, solar panels, TVs and other high tech goods all depend on them. Since these products are of high relevance to science and the economy, they're often referred to as key technologies. In other words: Without rare earths, assembly lines at Apple, Tesla, Samsung and others would quickly come to a halt. The search for alternatives is ongoing but very few make it into mass production. Understandably, rare earths have long been a bone of contention driven by economic interests.

The extraction process is extremely technology and labor-intensive. Rare earths don't come as large ore deposits, unlike iron. Instead, they're often mixed with other metals. Extraction requires acids, bases or chloride to break down the ore, creating large amounts of contaminated soil in the process. Contaminants include heavy metals or even radio-active materials like thorium that are "stored" in dedicated facilities - or lakes. Consequently, many countries object to the extraction since no-one likes toxic waste in their backyard. That's why countries with less strict environmental laws (China, India) or secluded extraction sites (Australia) are key players in this business. The US used to be the main supplier until China undercut them to the point where extraction was no longer economically sustainable.

The price of extraction: Toxic landscapes

The price of extraction: Toxic landscapes

Today, China has cornered the market - to great effect both economically and politically. Time and time again, export constraints shook the high-tech industry and the latest trade war between China and the US doesn't help matters. To the astonishment of business insiders, penalty tariffs were imposed that have the big players in Silicon Valley gasp for air and may significantly harm the US economy. Naturally, scarcity of resources and skyrocketing prices fuel the global hunt for new deposits, from Brazil to Australia, all across the US and all the way up to South Greenland - with some success. Still, environmental regulations and labor requirements have yet to be carefully examined to determine whether extraction is a viable endeavor in these cases.

Reclaiming existing sites, for example in the US, also involves a high degree of complexity. Not only are proper permits missing so is the technical knowledge of modern extraction methods. All these hurdles considered, recycling, often shunned by companies, suddenly seems a viable alternative. Instead of simply disposing of technical waste to Africa and thus poisoning entire regions, one could also recycle it. But since this is cost-intensive, companies choose to carry on lackluster research into new extraction sites. While recycling gold, silver and other metals is fairly straightforward, rare earths frequently include other metals that are hard to separate. By the way, the recycling rate currently sits at an underwhelming one percent.

Of course, companies are desperately looking for ways to lessen the dependency on their providers. For instance, the elements neodymium and dysprosium are featured in super-strong magnets that can replace gearboxes and lead to low-maintenance requirements. They are used in many Chinese wind turbines. But, what sounds like green energy has severe environmental implications during production - just not on our doorstep. European manufacturers are currently trying to scale down resource requirements through technologies like superconducting high magnetic field coils that could eventually replace permanent magnets. We're still years away from general market availability, though, so China will continue to have a strong bargaining chip for the foreseeable future.

What do you think? Should we enter into long-term dependencies just to save some money?

It is fine to extract these minerals to provide us with technology that take for granted on a day to day basis. We forget we only have one earth and the more we poison the environment, it will become smaller and we will all suffer at the end. Spend the money so there is a win win situation and explain why it will cost more. Making maximum profit for the short term has deadly outcomes for all in the long run....

You've touched on a very important subject Sven, and have elicited excellent responses (especially from Jon Demane).

The problem is greed, and humans have lots of it. The greed of the multinationals feed on the greed of individuals. Stability is not enough. It's all about unfettered growth, lots of it. To our detriment.

You've heard the expression "no pain, no gain"? It's been somewhat reversed to "gain now, forget the pain till later".

Of course China has cornered the market. It's become the world's factory, and the world demand for its products is endless. The big multinational corporations started this, and we have become addicted to living large today on the cheap, and hoping that tomorrow never comes to bite us in the arse, like the proverbial ostrich with its head in the sand.

There are two untouched treasure chests of every conceivable mineral left on the Planet. One Is Myanmar and the other is Afghanistan. Both have been untouched by mining companies. However, China now I believe is starting to get involved in extracting minerals on a small scale. That is because of decades of warfare. Myanmar (Burma) was looked at as a pariah Nation due to it's decades of Military rule. I have been to Myanmar countless times in search of one element (Sb) Antimony. I have never been to Afghanistan due to ongoing warfare. However, I have read reports that both Nations hold enormous mineral wealth, upwards of $4 Trillion each and that amount was calculated decades ago. I believe for the time being, electronics have to be recycled in the US for extraction of these needed elements for the foreseeable future. A lot of electronics are dumped in India where environmental laws are weak or not enforced at all. Time will tell on what will happen.

David Clarke, I must correct you on your comment.

Thorium is a by-product of uranium, as we know, used in nuclear reactors, but scientists have discovered a method of causing the danger of radioactive nuclear fission to become safe by using a method to side-step radioactivity by changing one 'particle' in the equation to create Thorium.

This is very expensive to create at present, although some electricity-generating reactors using Thorium have been built in Europe.

The problem lies in the fact that uranium mining must exist, which takes us to your other comment relating 'toxic landscapes'.

Natural landscapes are non-toxic no matter what rare, or other minerals are in their natural state in the ground of planet Earth.

The toxic element of the minerals is created by scientists, human beings discovering methods to 'create wealth'.

They are 'short-term people' who want to live with lots of money, glamorous life-styles, to be rich and famous for the 'Now Factor' of living a a few, not millions of years, and not caring about their children's children's children who will inherit Planet Earth.

Without care and consideration Earth will become a poisonous disaster for people who will not have a pleasant life, simply because selfish people want goodies NOW, not caring for Earth in 50, 100, 1000, 1 million years ... which will have been devastated by raping the planet of rare minerals, and guilty of the toxic conversion of stable, in-ground minerals which are 100% harmless in their natural state.

Babies and young children will inherit 'tomorrow', they deserve a healthy future and a long life, so why is the greed, environmental decimation and selfishness of senseless adult, incompetent humans destroying an agony-free future which is the birthright of every creature on Earth.

Hi Sven,

Thumbs up for your article. I'm pretty sure that in many labs around mother earth they are investigating alternative materials, perhaps even less environmentally harmful (?), to be used. If so, what do we know so far? Could this be your next story?

Keep going fellow traveller

Thanks for the great story. This is something I've wondered about knowing that China is the major provider these days. Please feel encouraged to do a followup on this. From here it seems like rare earths are a stop-gap measure until safer materials are found. Maybe organics or nano-manufacturing?

A great article Sven.

Above all else the cost to the environment by mining the minerals, all minerals in fact is enormous.

Baotou in China is where the neodymium and dysprosium is mined and has created a disasterous situation with the tailings in the poisonous lake to seep into the groundwater.

All other minerals, rare or otherwise are necessary to produce almost every household and other products used by humans most needed some, They Want them at any cost, (another new car, phone, TV, microwave)

Beginning with mining the minerals the machinery is manufactured using mined minerals converted to metal.

The machinery uses oil products from the ground, the transport to carry the minerals, the factories creating the base metals, the factories manufacturing the end products, the ships to distribute the products around the world, transport to deliver the products to point of sale, all using oil products because most of the mining and transport machinery and vehicles operate with diesel engines.

Add to the equation the cell phones, home appliances, TV's, and the rest of the appliances plus vehicles and machinery, most or nearly all are manufactured using electricity produced by coal fuelled generators, coal from mines = machinery and transportation required.

The above points to electric vehicles, beginning as minerals, manufactured using electricity from coal-fired generators and touted as 'saving the environment', but not the driver with a cell-phone, or the sales team in a building, the building material transported by diesel powered engines.

The wind turbines costing more to produce and maintain than the non-saving of the compared cost of electricity produced by coal-fired generators.

The minerals, the rare and not so rare, mined all over the world on a regular basis to create all the products at a cost of irreparable damage to the world-wide environment.

When the minerals have all been used up, what then Mr & Mrs Human, a trip to another planet in a transport rocket made from "metal'.....?

Thorium might become useful as a reactor fuel. There is plenty available.

Toxic landscapes were full of the toxic substances before they were mined, so why do they become more toxic?

I think we need more discussion on this subject. You have raised many vital issues in this excellent article. The question may be, "can we sustain the manufacturing of these products and can we limit their production"? Some of the computerized products, eg TVs have become very cheap in recent years and the recycling industry is not working well. Tonnes of valuable rare earths are being dumped in landfills in spite of efforts to recycle. We need to work harder at recycling.

Great article Sven.